Electric Vehicle Tax Credit Colorado

If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. Federal tax credits of up to 7500 are still available for most EVs though Tesla met its max at the end of last year and General Motors phases out by April.

Electric Car Tax Credits What S Available Energysage

Electric Car Tax Credits What S Available Energysage

To qualify electric vehicles and plug-in hybrid electric vehicles must have a maximum speed of at least 55 MPH.

Electric vehicle tax credit colorado. Colorados tax credits for EV purchases. Chevy Bolt Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche Taycan and Jaguar I-Pace. Opponents of the electric vehicle tax credit also say its a more costly way to curb emissions than other economy-wide climate policies.

Titled and registered their vehicle in Colorado. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles. The capacity of the battery used to power the vehicle impacts the federal tax credit you can get.

Size and battery capacity are the primary influencing factors. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at The Tax. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case.

But theres one thing in decline the tax credits available to new electric-car buyers. New EV and PHEV buyers can claim a 5000 credit on their income tax return. Electrical automobile advocates woo Republicans to again extra tax credit Colorado Springs Gazette.

The maximum credit is 500 for vehicles with a gross vehicle weight rating GVWR of 10000 pounds lbs or less and 1000 for vehicles with a GVWR of more than 10000 lbs. The vision for the Colorado Electric Vehicle Plan 2020 is. In Colorado drivers are eligible for a state tax credit of up to 4000 on the purchase of a new EV or Plug-in Hybrid Electric Vehicle.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a vehicles power source with an alternative fuel power source. The state of Colorado also offers a tax credit for the purchase of alternative fuel vehicles including plug-in electric vehicles. For example a study by ClearView Energy Partners last year found the electric vehicle tax credits reduced emissions at a carbon price ranging from 114 to 237 per ton.

Purchased or converted their vehicle. Electric vehicle advocates are ramping up efforts to lobby Republicans in the new Congress hoping to push through policies such as expanded tax incentives that. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Large-scale transition of Colorados transportation system to zero emission vehicles with a long-term goal of 100 of light-duty vehicles being electric and 100 of medium- and heavy-duty vehicles being zero emission. Motor vehicles and trucks that do not qualify Certain motor vehicles and trucks that run on electricity do not qualify for the credit. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. As of January 1 2017 the value of the credit is a flat rate of 5000 that can be applied at the time of purchase. Yes most electric car tax credits are available if they qualify.

No credit is allowed if any of the. Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

Contact the Colorado Department of Revenue at 3032387378. Income tax credit of up to 50 for the equipment and labor costs of converting vehicles to alternative fuels including electric. Since the federal tax credit is based on the capacity of the vehicles battery pack the original cost of the vehicle does not matter.

Examples of electric vehicles include. Admin November 27 2020. Colorado Electric Vehicle Tax Credit.

The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question. Electric and plug-in hybrid cars purchased after 2010 are eligible for the federal tax credit. Additionally the Colorado Colorado Department of Revenue only offers this incentive to qualified individuals who have.

Both the state and the federal government have tax credits that you can take advantage of when purchasing an electric vehicle. The purchaser or lessee need not acquire a motor vehicle or truck in Colorado to qualify for the credit so long as Colorado titling and registration requirements are met. The credits which began phasing out in January will expire by Jan.

The Colorado state tax credit will decrease to 2500 in 2021 and continue to decline until it is phased out entirely at the end of 2025. Questions about the Colorado Electric Vehicle Tax Credit. Since 1992 Colorado has offered the innovative motor vehicle income tax credit for people who purchase or lease alternative fuel vehicles or who convert their existing vehicle to run on an alternative fuel source.

Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. A bill that would extend Colorados tax credits for electric vehicles through 2025 is intended to help accelerate the goal of increasing the number of zero-emission vehicles on the states roads.

Kia Niro Ev Arrives In Paris As E Niro Packing 300 Miles Of Range Kia Best Electric Car Hyundai

Kia Niro Ev Arrives In Paris As E Niro Packing 300 Miles Of Range Kia Best Electric Car Hyundai

Electric Vehicle Review A Sustainable Alternative For Students Who Can Afford Price Nissan Electric Internship Program Student

Electric Vehicle Review A Sustainable Alternative For Students Who Can Afford Price Nissan Electric Internship Program Student

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

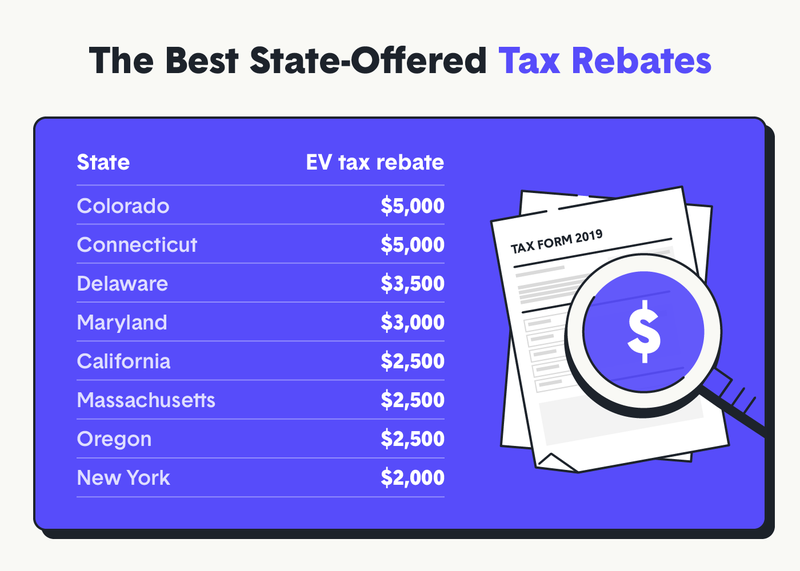

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How Do Electric Car Tax Credits Work Credit Karma

How Do Electric Car Tax Credits Work Credit Karma

2014 Chevrolet Spark Ev Made In South Korea Available In California And Oregon 19 995 After Federal Tax Credit Chevrolet Spark New Chevy Chevy

2014 Chevrolet Spark Ev Made In South Korea Available In California And Oregon 19 995 After Federal Tax Credit Chevrolet Spark New Chevy Chevy

What Electric Car Tax Incentives Are Still Available In 2021 Find The Best Car Price

What Electric Car Tax Incentives Are Still Available In 2021 Find The Best Car Price

Gm Announces 300 Million Investment For New American Made Electric Car Chevrolet Volt Chevy Bolt Chevrolet

Gm Announces 300 Million Investment For New American Made Electric Car Chevrolet Volt Chevy Bolt Chevrolet

Chargepoint Now Has 30 000 Charging Stations Nearly 3x More Than Us Starbucks Locations Starbucks Locations Fleet Electric Vehicle Charging

Chargepoint Now Has 30 000 Charging Stations Nearly 3x More Than Us Starbucks Locations Starbucks Locations Fleet Electric Vehicle Charging

The Colorado Department Of Transportation Cdot With A Budget Unable To Maintain Colorado S Extensive Highwa Ev Charging Stations Transportation Ev Charging

The Colorado Department Of Transportation Cdot With A Budget Unable To Maintain Colorado S Extensive Highwa Ev Charging Stations Transportation Ev Charging

Electric Cars Are Already Less Expensive To Own And Operate Than Gas Guzzling Vehicles According To Study Electric Cars Electric Vehicle Charging Car Charging Stations

Electric Cars Are Already Less Expensive To Own And Operate Than Gas Guzzling Vehicles According To Study Electric Cars Electric Vehicle Charging Car Charging Stations

How To Claim An Electric Vehicle Tax Credit Enel X

How To Claim An Electric Vehicle Tax Credit Enel X

New Nissan Leafs For 11 840 In Colorado 11 510 In Texas Nissan Leaf Nissan Leaf Electric Cars Nissan

New Nissan Leafs For 11 840 In Colorado 11 510 In Texas Nissan Leaf Nissan Leaf Electric Cars Nissan

Your State Might Be Offering These Awesome Perks For Evs And You Don T Even Know It Incentive How To Create Infographics Infographic

Your State Might Be Offering These Awesome Perks For Evs And You Don T Even Know It Incentive How To Create Infographics Infographic

Pin On Food Wedding Room Inspirations Fitness

Pin On Food Wedding Room Inspirations Fitness

How Many Electric Cars Are There In The Usa Cars Usa Ev Charging Totaled Car

How Many Electric Cars Are There In The Usa Cars Usa Ev Charging Totaled Car

Tax Credits Drive Electric Northern Colorado

Comments

Post a Comment